|

Home | Libraries | People | FAQ | More |

boost::accumulators::impl::peaks_over_threshold_impl — Peaks over Threshold Method for Quantile and Tail Mean Estimation.

// In header: <boost/accumulators/statistics/peaks_over_threshold.hpp> template<typename Sample, typename LeftRight> struct peaks_over_threshold_impl { // types typedef numeric::functional::average< Sample, std::size_t >::result_type float_type; typedef boost::tuple< float_type, float_type, float_type > result_type; typedef mpl::int_< is_same< LeftRight, left >::value?-1:1 > sign; // construct/copy/destruct template<typename Args> peaks_over_threshold_impl(Args const &); // public member functions template<typename Args> void operator()(Args const &); template<typename Args> result_type result(Args const &) const; };

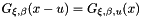

According to the theorem of Pickands-Balkema-de Haan, the distribution function  of the excesses

of the excesses  over some sufficiently high threshold

over some sufficiently high threshold  of a distribution function

of a distribution function  may be approximated by a generalized Pareto distribution

may be approximated by a generalized Pareto distribution

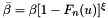

with suitable parameters  and

and  that can be estimated, e.g., with the method of moments, cf. Hosking and Wallis (1987),

that can be estimated, e.g., with the method of moments, cf. Hosking and Wallis (1987),

and

and  being the empirical mean and variance of the samples over the threshold

being the empirical mean and variance of the samples over the threshold  . Equivalently, the distribution function

. Equivalently, the distribution function  of the exceedances

of the exceedances  can be approximated by

can be approximated by  . Since for

. Since for  the distribution function

the distribution function  can be written as

can be written as

and the probability  can be approximated by the empirical distribution function

can be approximated by the empirical distribution function  evaluated at

evaluated at  , an estimator of

, an estimator of  is given by

is given by

It can be shown that  is a generalized Pareto distribution

is a generalized Pareto distribution  with

with  and

and  . By inverting

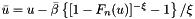

. By inverting  , one obtains an estimator for the

, one obtains an estimator for the  -quantile,

-quantile,

and similarly an estimator for the (coherent) tail mean,

cf. McNeil and Frey (2000).

Note that in case extreme values of the left tail are fitted, the distribution is mirrored with respect to the  axis such that the left tail can be treated as a right tail. The computed fit parameters thus define the Pareto distribution that fits the mirrored left tail. When quantities like a quantile or a tail mean are computed using the fit parameters obtained from the mirrored data, the result is mirrored back, yielding the correct result.

axis such that the left tail can be treated as a right tail. The computed fit parameters thus define the Pareto distribution that fits the mirrored left tail. When quantities like a quantile or a tail mean are computed using the fit parameters obtained from the mirrored data, the result is mirrored back, yielding the correct result.

For further details, see

J. R. M. Hosking and J. R. Wallis, Parameter and quantile estimation for the generalized Pareto distribution, Technometrics, Volume 29, 1987, p. 339-349

A. J. McNeil and R. Frey, Estimation of Tail-Related Risk Measures for Heteroscedastic Financial Time Series: an Extreme Value Approach, Journal of Empirical Finance, Volume 7, 2000, p. 271-300